In Accordance to the Journal of Accountancy’s 2024 Financial Metrics Examine, companies maintaining a group interval beneath forty five days show superior money circulate administration. Financial establishments analyze DCR to gauge credit score insurance policies and money conversion cycles. A firm amassing $900,000 from $1,000,000 in credit score gross sales achieves a 90% DCR, indicating effective assortment practices. Firms monitoring DCR monthly establish fee delays early, enabling proactive measures to forestall cash flow disruptions. This sort of evaluation, in enterprise accounting, is named accounts receivables turnover. You can calculate it by dividing your net credit sales https://www.kelleysbookkeeping.com/ and the average accounts receivable balance.

If we imagine a scenario where all prospects delay their payments, the corporate wouldn’t be receiving any cash, although it may be producing significant gross sales on paper. This can create a cash crunch, making it challenging for the corporate to meet its common operational expenses, together with worker salaries, utility payments, and provider invoices. The average assortment period is important because it measures the effectivity of a company by way of amassing payments from clients. A low common assortment period is nice for the company as a end result of they will be recouping prices at a sooner price. However, if the average collection period is too low, it can be a deterrent for potential purchasers.

- They throw out items and companies (credit sales) and count on money to return.

- Since Mosaic presents an out of the box billings and collections template, you presumably can automatically floor excellent invoices by due date highlighting precisely the place to focus your collection efforts.

- According to the Affiliation of Monetary Professionals’ 2024 Working Capital Survey, corporations sustaining a median debtor age below 40 days achieve 35% better money move optimization.

- Industries similar to banking (specifically, lending) and real estate construction normally goal for a shorter average assortment period as their cash flow relies closely on accounts receivables.

- This isn’t a nasty figure, considering most companies gather inside 30 days.

Impression Of Average Assortment Period On Your Bottom Line

For a more precise analysis of your Common Collection Interval, think about making changes that account for seasonal sales patterns, new product launches, or adjustments in credit coverage. These components may cause spikes or dips in gross sales quantity, which might not characterize the typical assortment expertise. For occasion, if you’ve simply had a major product rollout, your assortment interval could be artificially low due to an influx of money.

There’s no one-size-fits-all answer for what makes a « good » Common Assortment Period. Ideally, a shorter assortment interval is generally most well-liked, because it signifies that the corporate collects receivables shortly and has efficient credit score and collections practices. This sometimes suggests a well-managed money circulate and a more financially secure operation, as funds are being reinvested into the business sooner. The Common Collection Ratio Calculator is an essential financial software for businesses to measure the effectiveness of their accounts receivable administration over a number of periods.

Knowledge Sheets

It’s important to suppose about the trade context, as some industries naturally have longer assortment durations as a end result of their business fashions. The common assortment interval is the timea company’s receivables may be transformed to cash. It refers to how quickly the customers who bought items on credit pays back the supplier. The earlier the supplier will get the funds, the higher average collection ratio it’s for enterprise as a end result of this fund is a large supply of liquidity.

Common Assortment Period: Understanding Its Importance In Enterprise Finance

Check out this on-demand webinar that includes Versapay’s CFO for insights on the crtical metrics you must be focusing on right now. Grey was beforehand the Director of Marketing for altLINE by The Southern Financial Institution. In 2020, the company’s ending accounts receivable (A/R) balance was $20k, which grew to $24k within the subsequent year. Suppose an organization generated $280k and $360k in web credit gross sales for the fiscal years ending 2020 and 2021, respectively.

Nevertheless, the figure can even represent that the corporate offers extra flexible payment terms in terms of excellent payments. If your goal is to collect inside 30 days, then a median collection period of 27.38 would sign effectivity. If your common collection period was considerably longer than your goal assortment phrases, that’s indicative of a need to enhance your collections efforts. There are many ways you can enhance your processes, starting from simple—such as utilizing collections e-mail templates—to extra transformative—like investing in accounts receivable automation software program. For instance, if your organization permits purchasers 30-day credit, and the typical collection interval is forty days, that is a downside. Nevertheless, an average assortment interval of 25 days means you are accumulating most accounts receivables before the tip of the 30 days.

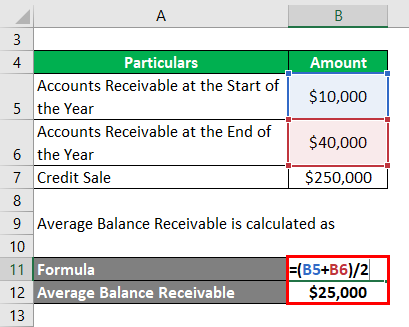

The average assortment interval is calculated by dividing the online credit score gross sales by the average accounts receivable, which provides the Accounts receivable turnover ratio. To determine the common collection period, divide three hundred and sixty five days by the accounts receivable turnover ratio. The common assortment period is the time it takes for a business to gather payments from its customers after a sale has been made. Businesses aim for a lower average assortment interval to make sure they have enough cash to cowl their bills.

Whereas leveraging the Average Assortment Period as a financial barometer has its merits, it’s essential to recognize potential drawbacks. For one, it represents a mean, meaning outliers—customers who pay exceptionally early or late—can skew the figure, providing a distorted view of your assortment efficiency. Furthermore, this average doesn’t present an in depth breakdown by buyer, so it’s not effective for identifying particular late payers who could be edging in the course of default. Providing early cost incentives is a tried-and-true method to spice up your assortment efforts. Encouraging purchasers to settle their accounts sooner than the due date can significantly shorten your Average Assortment Interval. To optimize your collection course of, you probably can employ a variety of strategies.

Add a Comment